A Creative Growth Engine

Fueled by an Entrepreneurial Spirit.

In today’s crowded financial services landscape, every company is asking the same question:

How do I differentiate my organization from my competitors in order to acquire new customers?

It was only a few short years ago when financial institutions were using technological advancements as a way to differentiate and acquire new customers. Today, online banking and mobile deposit capabilities are expected as the norm. So, as technology continues to become a commodity, financial service institutions are left with only one solution to help drive customer acquisitions: focusing on the customer relationship. Basically, you need to create personal connections that provide unique value to your customer.

But how do you do this in a way that sets you apart from the rest?

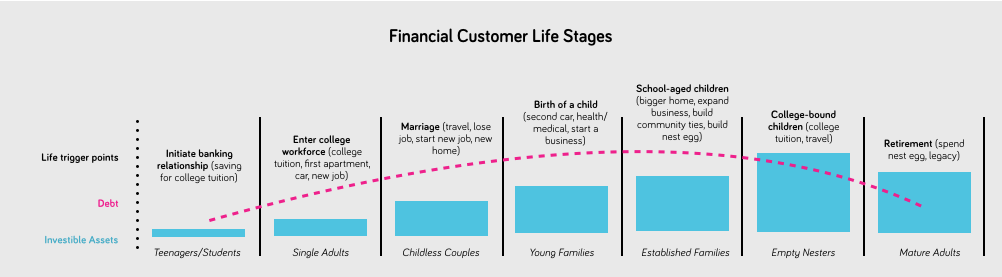

First, create stronger target segments and don’t rely on a one-size-fits-all marketing approach to drive customer acquisition. The financial needs of an 18-year-old are far different than a 65-year-old, and while most institutions understand that, their marketing efforts don’t always reflect it. So, your marketing strategy must be tied to a consumer’s life journey and the various stages that most individuals will experience along the way. Once you start to target consumers based on their lifestyle, you can address their individual pain points and showcase exactly what your financial institution does to help solve their specific problems. Keep in mind, everyone offers loans, credit card options and financial advice, so focus on the advantages of your institution beyond just the product solution.

There are universal life events that a consumer may experience over time. Although these life events happen at varying ages for each individual, the likelihood is that each customer will experience a large majority of these events at some point in their personal journey. These expected life events range from opening your first credit card to paying student loans, saving and buying your first house, getting married, having children, all the way to investing for retirement. Mapping your marketing strategy tactically to such life stages will help better determine when your customer may be more primed to receive targeted messaging based on relevant life trigger points. This will drive opportunities to provide unique solutions to fit their unique needs.

We categorize these stages into the following categories:

This individual is just beginning their career. They’re no longer dependent on their parents and are now experiencing their first set of bills – college loans begin, apartment rent and utilities are due, new cars are purchased, groceries are needed, etc. It can be an overwhelming time for these young adults as they begin independently navigating their financial life. While this group can be viewed as one that is not a profit center for the bank, they’re seeking the most advice and have the largest potential to help your bottom line in the long run. With 58% of people stating their main reason for staying with a financial institution as “it’s easier to stay where I am,” ensuring that your brand is meeting the needs of this group early in their financial journey is imperative to long-term success. Therefore, aligning your brand as their holistic financial partner now is likely to drive continued business for many years.

At this point, most of these individuals have a pre-existing relationship with a bank, but have yet to begin investing. This creates an advantage for their current bank to proactively educate the consumer on investment options and strategies for long-term success. Additionally, this audience is looking and seeking trusted individuals who can give them advice.

Here are a few strategies to consider implementing:

Finally, keep in mind to always be yourself. In banking and finance, it’s difficult to differentiate. Even with strong rates, without building a personality and brand dedicated to solving customer problems, you run the risk of not converting customers for the long run.

As you think through your brand’s marketing efforts and the seasonality of corresponding plans, develop a campaign that speaks to the individual challenges that your customers are facing. By strategically positioning your brand as one that’s with the consumer for each life stage, you can create a strong, lasting partnership and provide a service that feels different than the rest of the competition.

Could your financial institution use a marketing boost? Feel free to reach out, and we’ll be happy to talk shop.